The Loan Consolidation Companies PDFs

Wiki Article

Personal Loan For Debt Consolidation Can Be Fun For Everyone

Table of ContentsDebt Consolidation Loans - An OverviewExcitement About Personal LoansSome Known Details About Loan Consolidation Companies 3 Simple Techniques For Personal LoansThe 10-Minute Rule for Small Business Loans9 Easy Facts About Personal Loans ExplainedBad Credit Loans Fundamentals ExplainedThe smart Trick of Bad Credit Loans That Nobody is Talking About

You'll be able to act quicker and also might be taken a lot more seriously by sellers if you have a preapproval letter in hand.

You may have an inadequate credit report document and also wind up decreasing your credit rating. great site. Personal fundings offer a versatile kind of money, as they can be made use of for almost any kind of objective. In this chart compiled from Lending, Tree customer data, you can see that financial obligation consolidation is one of the most common reason for getting an individual financing.

Some Known Details About Bad Credit Loans

This is likely due to extra beneficial products that can be made use of for residence renovations such as house equity credit lines. How Do I know If I Can Afford It? When looking for a personal lending, you have the option of selecting the repayment plan that best fits your earnings and also capital.25 percent or 0. Half reduction in your APR.Some people prefer to pay off their funding over a number of months or years in order to maintain their monthly settlements as low as feasible. Others prefer to repay their finance immediately, so they choose the greatest month-to-month payment alternative.

It might not appear so because your regular monthly repayments are so much lower, yet you wind up paying much more for the loan over the training course of its life. view publisher site. Customers must aim to invest no more than 30 percent of their earnings on financial obligation, that includes mortgages, vehicle loan, and also individual financings.

The smart Trick of Small Business Loans That Nobody is Talking About

Personal lending lending institutions, on the various other hand, are a lot more forgiving, specifically if you have a strong credit report as well as evidence of income. Home loan loan providers, in specific, are well-known for denying finances to persons with debt-to-income ratios of more than 40%. You might be able to stretch this proportion a little to handle a higher month-to-month repayment if you think you can temporarily handle greater repayments in order to save a great deal on interest.This should just be done as a last hope and only if you have a back-up plan in position, such as a companion's income or an emergency situation fund.

Our goal is to offer you the tools and also self-confidence you require to boost your financial resources. Although we receive compensation from our companion lending institutions, whom we will certainly constantly recognize, all opinions are our very own. Trustworthy Operations, Inc. NMLS # 1681276, is described right here as "Credible."Most buyers do not spend a great deal of time finding out exactly how to pick a home mortgage.

See This Report on Personal Loans

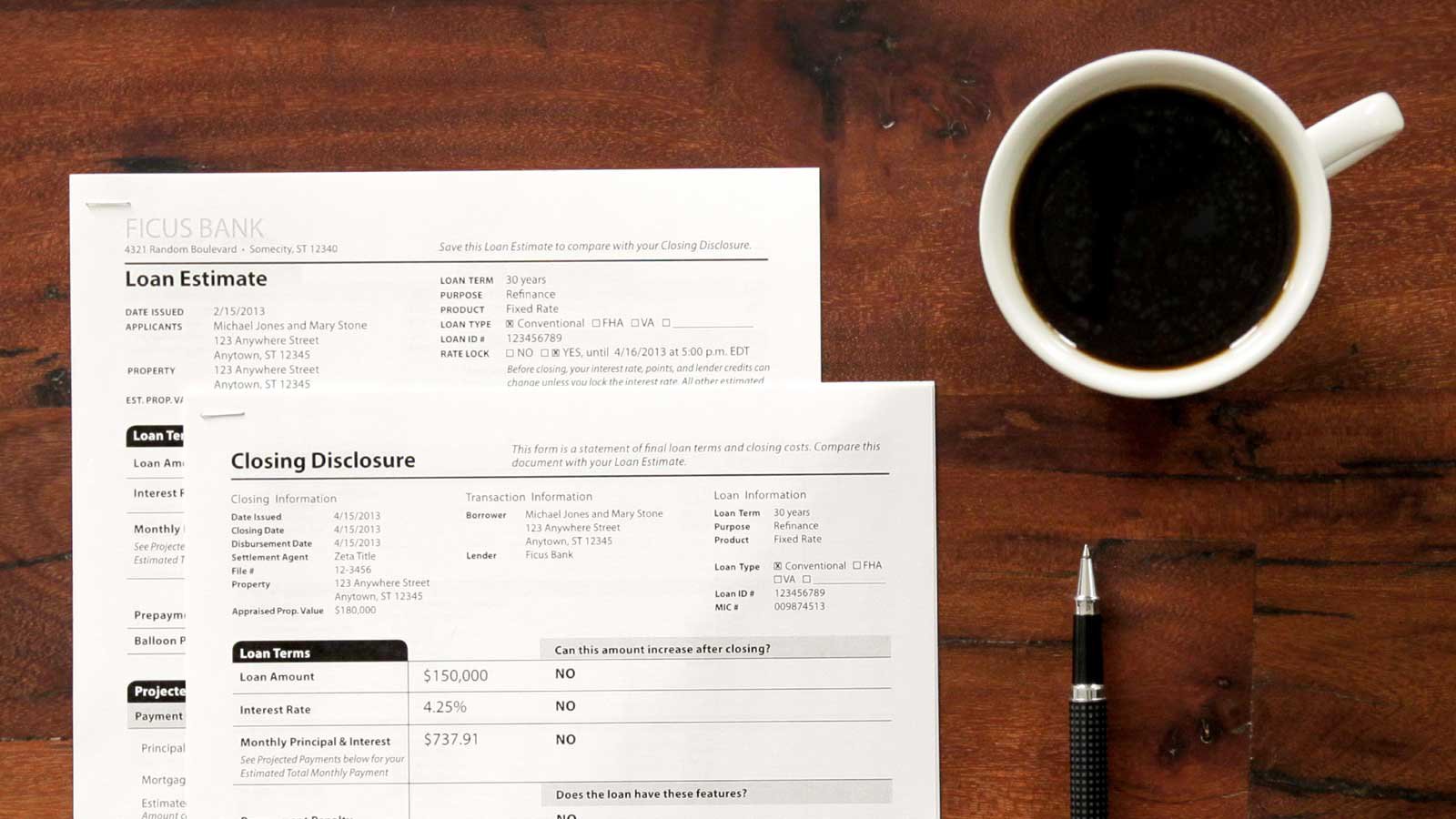

It's crucial to understand exactly how to select a mortgage. Getting a house will certainly have a huge influence on your funds, and obtaining the most budget-friendly home mortgage will certainly permit you to totally enjoy your new house instead of stressing over just how much it sets you back.Closing costs: Usually 2% to 5% of the list prices, depending upon your funding and also place. The higher end is most likely to use if your area fees transfer taxes on home sales. Besides taxes, origination fees and points are the largest closing prices. Relocating expenses: A local DIY action may not run you much, however an expert out-of-state move can cost thousands of bucks.

Pointer: Intend on making a down payment of at the very least 3% for a conventional car loan. If you can put down 20%, you won't need to spend for home mortgage insurance coverage. Repeating prices The very best home loan options can lessen the repeating costs in your monthly home mortgage repayment. Principal as well as passion: Your principal is the quantity you borrow to buy a home.

What Does Personal Loan For Debt Consolidation Do?

The lower your principal and rate of interest, the reduced your monthly payment will be. Property taxes as well as homeowners insurance coverage: Your loan provider may require you to pay a part of your yearly residential or commercial property taxes as well as homeowners insurance with each mortgage settlement, especially if you put down less than 20% (see it here). Otherwise, you'll require to establish that cash aside yourself to pay these costs when they schedule., you'll require to budget for month-to-month association dues, though you'll pay them independently from your home loan. Debt-to-income proportion Producing a budget plan will likewise allow you to figure out exactly how much of your regular monthly income is going towards financial obligation.

So, if your regular monthly earnings is $6,000 and also you're currently investing $1,000 each month on fundings and bank card payments, see to it to budget plan no greater than $2,000 toward your month-to-month home loan payment. over here. Find out just how much you could owe month-to-month as well as over the life of a lending using our home mortgage repayment calculator listed below.

The Best Strategy To Use For Guaranteed Debt Consolidation Loans

You will certainly pay a total amount of over the life of the mortgage. Trustworthy makes getting a home loan simple. Find the ideal kind of home loan There's not one best type of home loan.

5% down and also as reduced as 500 when you put 10% down. Some lenders call for greater scores, as well as you'll pay for in advance and month-to-month home loan insurance policy premiums - consolidation personal loans.

8 Easy Facts About Bad Credit Loans Described

If you or your partner has served in the united state armed force, you may be eligible for a VA financing. It's finest to have a credit report in the mid-600s or higher. USDA loan Best for: Very-low-income to moderate-income purchasers in qualifying suv and backwoods USDA financings permit you to place absolutely nothing down, and they have no minimal credit report need.Conventional10, 15, 20, 303 - loan consolidation companies. 62%3% Jumbo15, 303. 68%10% - 20% FHA15, 303. 43%3. 5% - 10% VA15, 303. 30%No down settlement requirement USDA15, 303. 50%No down payment need 3. Choose the right lending term One of the most common lending term is three decades, complied with by 15 years. Ask on your own these questions when selecting between a 15- vs.

Select a fixed-rate or adjustable-rate home loan While 30-year as well as 15-year fixed-rate home mortgages are one of the most popular alternatives when choosing a house lending, you can also choose an variable-rate mortgage (ARM). ARMs have a set rates of interest for the very first few years, and also after that, the rate of interest will alter on an established schedule for the remainder of the finance term.

What Does Debt Consolidation Loans Do?

Reliable can assist you compare mortgage prices from multiple lenders look into our partner loan providers in the table below. Loading widget - purchase-rate-table When choosing in between a fixed-rate mortgage and also a variable-rate mortgage, here are some crucial concerns to ask yourself: Do you intend to relocate or re-finance before the fixed period on the ARM ends? If you plan to re-finance, just how does the cost to re-finance contrast with exactly how much you could minimize rate of interest with an ARM? Are you comfortable with the danger that you may not be able to sell or re-finance before the ARM's set rate runs out? Could you afford higher monthly payments? Do you prefer the stability of a fixed price due to the fact that you do not such as danger, or due to the fact that you prepare to keep your house long-term? Are rates of interest on ARMs dramatically reduced than passion rates on fixed-rate financings right currently? Just how much could you save? Month-to-month repayment will not change, Easy to forecast total long-term costs, Easy to understand, Greater rate initially, Can be a lot more expensive for short-term consumers Lower price originally, Can conserve short-term customers cash, Regular monthly payment might increase, Difficult to predict total lasting prices, Funding terms are more complicated 5.Good to recognize: A Freddie Mac research discovered that consumers can conserve an average of $1,500 simply by getting two home loan quotes instead of one. Customers who obtain 5 quotes can save $3,000 over the life of the loan.

Below's what to think about when deciding between offers from various loan providers: Rates: You want the lowest rate possible, all else being equivalent., you'll generally pay a higher rate. (APR) on each loan you apply for.

Report this wiki page